Newly released data shows lenders focused on underserved communities outperform lenders with less vigorous strategies

Homeownership Council of America analysis finds mortgage lenders that focus on underserved communities outperform lenders that take a less vigorous strategy.

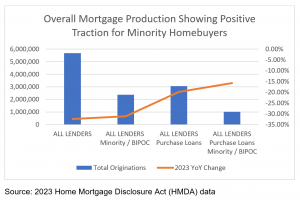

WASHINGTON, DC, UNITED STATES OF AMERICA, April 10, 2024 /EINPresswire.com/ -- With recently released 2023 figures from the annual Home Mortgage Disclosure Act (HMDA) report, careful analysis by HCA using Polygon Research’s HMDA-Vision system found some positive news around increased production volumes both overall and in home purchase lending to minorities. Additionally, the data shows standout results of lenders who have their own Special Purpose Credit Programs and outperformed their peers.“We are excited to see positive traction for BIPOC (minority) homebuyers even in the face of a very difficult market”, states Homeownership Council of America’s CEO Gabe Ewing del Rio, who organization has been working with the industry to facilitate Special Purpose Credit Programs in an effort to close the homeownership gaps for underserved communities. (Source Material: 2023 HMDA data https://homeownershipcouncil.org/news-from-hca)

These programs are strategically designed to target underserved communities, aiming to bridge financial gaps and promote inclusive economic growth. The data shows that the success of lenders embracing SPCPs underpins overall loan volume despite facing the lowest production in over five years.

A prime example of lenders having success with SPCPs was found with BMO Harris, who had positive gains of 22% in year-over-year originations in 2023, while the overall market showed a -32% YoY. HMDA data indicates that lenders like NFM Lending, NewRez, Guild Mortgage, and TD Bank, who have SPCPs, performed at least 30% better than the overall market.

Looking at the subset of home purchase mortgage production data, BMO Harris had an outstanding 424% increase in Minority Purchase Owner-Occupied originations between 2022 and 2023. NewRez had an impressive 285% increase for the same period.

This trend also underscores the pivotal role played by initiatives focused on underserved communities and the untapped potential of minority homebuyers. These efforts contribute to financial inclusion and stability and represent a substantial business opportunity for lenders while closing the wealth gaps and fostering a more inclusive and sustainable mortgage sector.

To learn more about HCA, visit: homeownershipcouncil.org

Gabe Ewing del Rio

Homeownership Council of America

+1 202-577-6751

gdr@homeownershipcouncil.org

Visit us on social media:

Facebook

LinkedIn

Instagram

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release